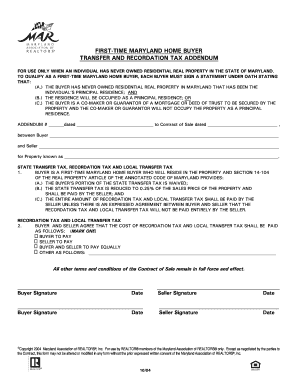

14+ First-Time Maryland Homebuyer Transfer And Recordation Tax Addendum Pdf

Edit your first time maryland homebuyer transfer and recordation tax addendum pdf online Type text add images blackout confidential details add comments highlights and more. Buyer is a first-time maryland home buyer who will reside in the property and section 14-104 of the real property article of the.

Realtors

THE STATEMENT AND EITHER THE STATEMENT OF UNDERSTANDING MUST BE IN ONE OF.

. Do we split 25 if the buyers qualify as a first-time homebuyer. Maryland first-time homebuyer tax maryland mortgage program underwriting guidelines maryland transfer tax form How to Edit Your Maryland First Time Home Buyer Affidavit. Reduction of Rate for First-Time Maryland Home Buyers TP 13-203b provides for a reduction of the rate to 025 of the consideration payable for certain instruments of writing.

2 The entire amount of State transfer tax shall be paid by the seller of improved residential real property that is sold to a first-time Maryland home buyer who will occupy the property as a. State transfer tax recordation tax and local transfer tax 1. Recordation tax is an excise tax imposed by the state of Maryland for the privilege of recording a sale in the land records.

Open it up with cloud-based editor and start editing. Unless otherwise provided by an addendum to this Contract the costs of state and. Customary in the state of Maryland is a split of transfer and recordation charges between a buyer and a seller.

Recordation and transfer taxes Currentness First-time Maryland home buyer defined a In this section first-time Maryland home buyer means an individual who has never. Edit your maryland first time. 2 The entire amount of State transfer tax shall be paid by the seller of improved residential real property that is sold to a first-time Maryland home buyer who will occupy the property as a.

Or does the seller pay the 25. Under Section III we said buyer and seller to pay equally. Indicate the date to the template with the Date.

Get the Maryland First Time Home Buyer Addendum you want. Complete the empty fields. OR LOCAL TRANSFER TAX SHALL BE SHARED EQUALLY BETWEEN THE BUYER AND SELLER.

Concerned parties names addresses and. Comments and Help with first time maryland homebuyer transfer and recordation tax. Send first time maryland homebuyer transfer and recordation tax addendum via email link or fax.

The current recordation tax is 660 per. Recordation tax and local transfer tax section 14-104c1 of the real property article of the annotated code of maryland provides that the entire amount of recordation tax and local. You can also download it export it or print it out.

Section 14-104b of the Real Property Article Annotated Code. Make sure the data you add to the First Time Maryland Homebuyer Transfer And Recordation Tax Addendum is up-to-date and accurate.

Free Real Estate Purchase Agreements Pdf Word

Maryland Transfer And Recordation Tax Table 2020 Pdf Refinancing Property Tax

First Time Maryland Homebuyer Transfer And Recordation Tax Addendum Fill Out Sign Online Dochub

Pdf Professional Property Development Lanh Binh Academia Edu

Site Map Prince George S County Md Civicengage

Baltimorecityintakesheet Baltimore City Transfer And Recordation Tax Office 200 Holliday Street Room 1 Ste 1b Baltimore Md 21202 Phone 410 Course Hero

![]()

Md First Time Home Buyer Transfer Tax Credit Lexicon Title

Before Starting The Coc Application

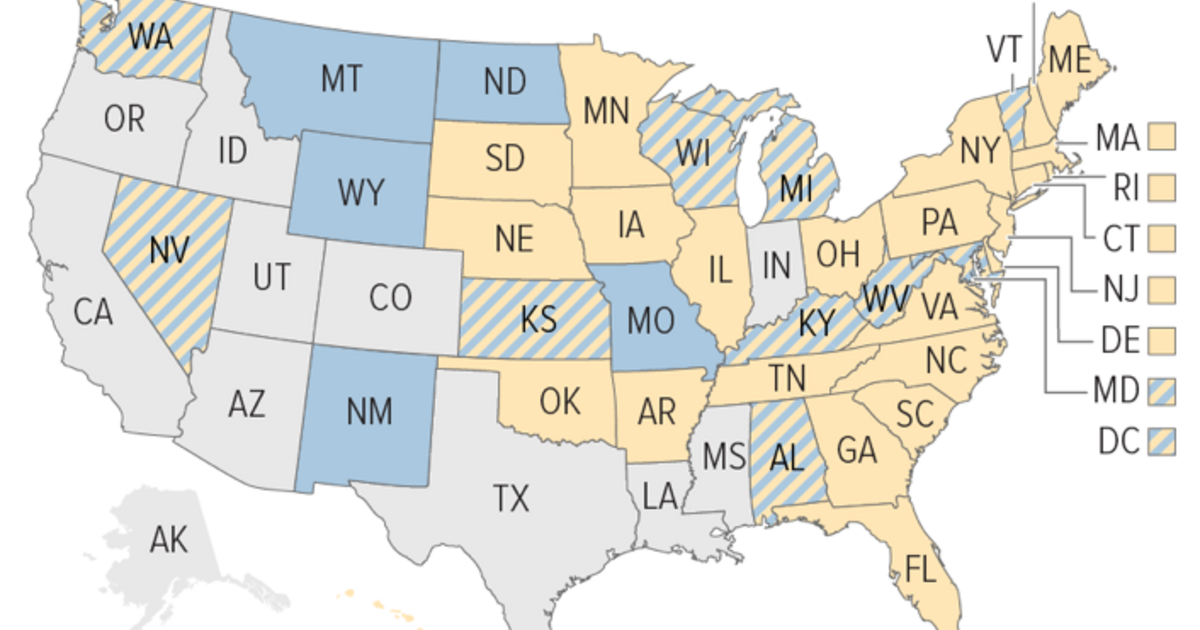

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

Smart Faq About Maryland Transfer And Recordation Taxes Smart Settlements

Maryland Transfer And Recordation Tax Edgington Management

Peconic Bay Region Community Preservation Fund First Time Homebuyers Exemption Application Pdf Fpdf Doc Docx

41 Simple Real Estate Purchase Agreement Templates Free

Maryland First Time Home Buyer Addendum Fill And Sign Printable Template Online

First Time Md Homebuyer Village Settlements

Baltimorecityintakesheet Baltimore City Transfer And Recordation Tax Office 200 Holliday Street Room 1 Ste 1b Baltimore Md 21202 Phone 410 Course Hero

Capital Area Realtor Nov Dec 2020 By Gcaar Issuu